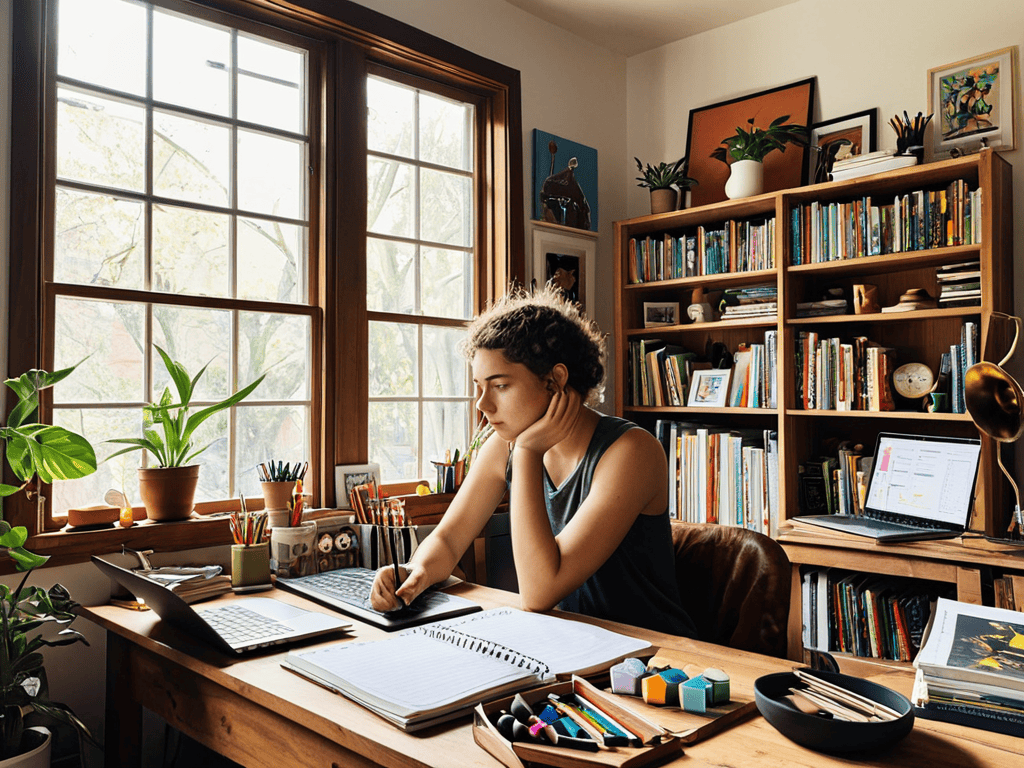

I still remember the day I decided to ditch my 9-to-5 job and pursue a career as a freelance writer. It was exhilarating, but also terrifying – especially when it came to figuring out a guide to financial planning for unconventional career paths. I had to navigate the unknown and create my own financial security, which was a daunting task. But what I learned along the way was that financial freedom is possible, even for those of us who don’t follow traditional career paths.

In this article, I’ll share my personal story and provide you with practical, no-nonsense advice on how to create a financial plan that works for you, not against you. You’ll learn how to manage your finances effectively, even when your income is unpredictable, and how to make smart investments that will help you achieve your long-term goals. My goal is to give you the tools and confidence you need to take control of your financial future, so you can focus on doing what you love, without worrying about money.

Table of Contents

Guide Overview: What You’ll Need

Total Time: several weeks to several months

Estimated Cost: $0 – $100

Difficulty Level: Intermediate

Tools Required

- Spreadsheet Software (e.g., Google Sheets, Microsoft Excel)

- Financial Calculator (optional, but recommended)

- Notebook or Journal (for tracking expenses and ideas)

Supplies & Materials

- Pen and Pencil

- Paper or Printer (for printing out plans and trackers)

- Internet Connection (for researching and utilizing online financial tools)

Step-by-Step Instructions

- 1. First, get real with your finances by tracking every single transaction you make for at least a month to understand where your money is going. This will help you identify areas where you can cut back and allocate funds to more important things, like building an emergency fund or investing in your career.

- 2. Next, set clear financial goals for yourself, both short-term and long-term. This could include paying off debt, building up your savings, or investing in a retirement fund. Having specific goals in mind will help you stay focused and motivated to make smart financial decisions.

- 3. Then, create a budget that accounts for your irregular income and expenses. This might involve setting aside a certain amount each month for taxes, health insurance, and other benefits that are typically provided by traditional employers. Be sure to also budget for unexpected expenses, like car repairs or medical bills.

- 4. After that, prioritize needs over wants by making a list of essential expenses, such as rent/mortgage, utilities, and food, and making sure those are covered before spending money on non-essential items. This will help you stay afloat during lean months and ensure you’re always able to cover your basic needs.

- 5. Fifth, diversify your income streams to reduce your reliance on a single source of income. This could involve taking on freelance work, investing in dividend-paying stocks, or pursuing alternative sources of revenue, such as renting out a spare room on Airbnb.

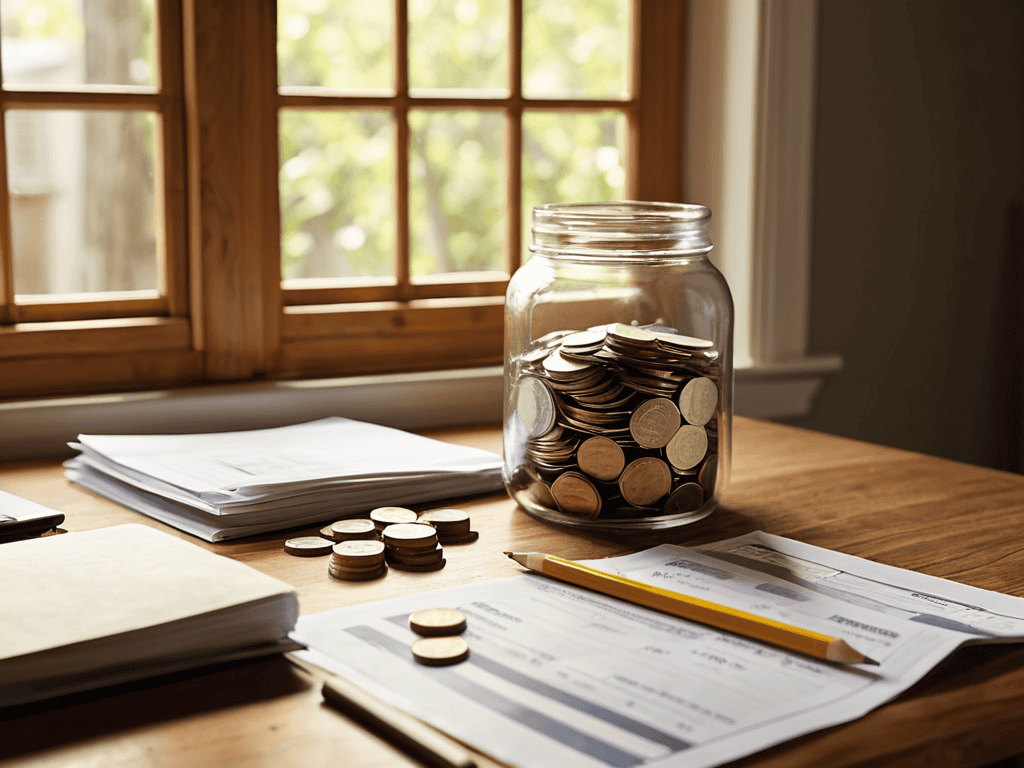

- 6. Next, build an emergency fund that can cover at least 3-6 months of living expenses in case you encounter a slow period or unexpected expenses. This will provide a safety net and help you avoid going into debt when unexpected costs arise.

- 7. Finally, stay organized and adaptable by regularly reviewing your budget and financial goals, and making adjustments as needed. This might involve using accounting software or working with a financial advisor to ensure you’re taking advantage of all the tax deductions and credits available to you.

A Guide to Financial Planning

When navigating the world of unconventional careers, budgeting for irregular income becomes a crucial skill. This means being able to manage finances during periods of feast and famine, ensuring that savings are prioritized and expenses are kept in check. A key strategy is to set aside a portion of income during prosperous months, which can then be used to supplement leaner times.

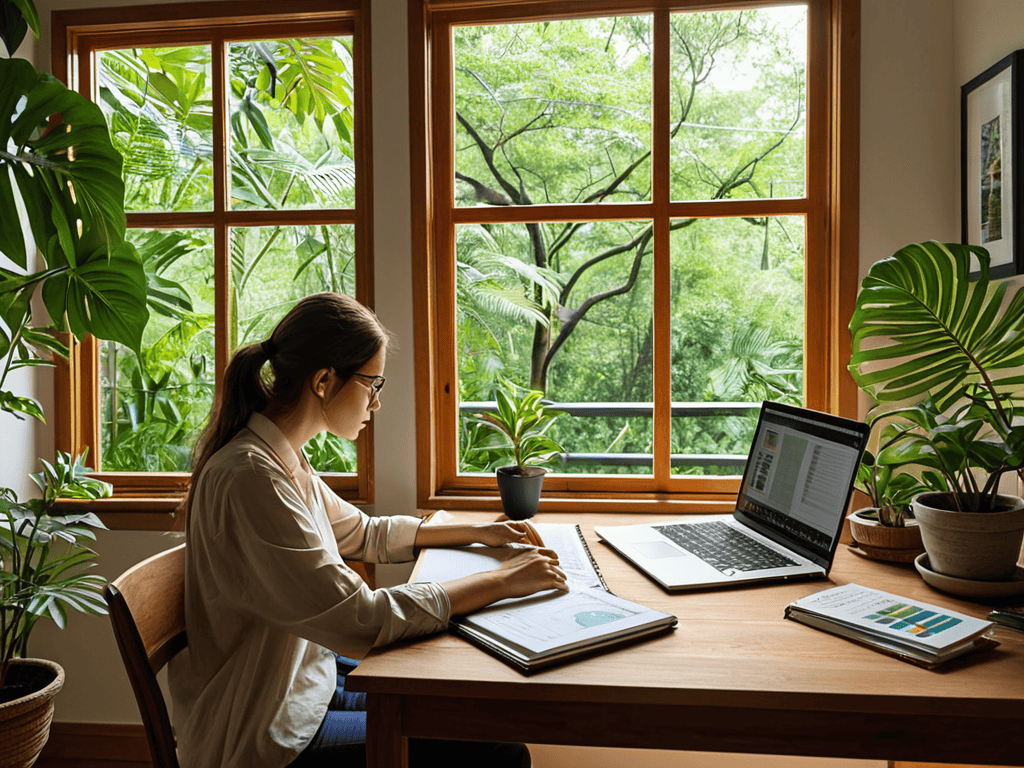

Investing as a freelancer requires a unique approach, taking into account the unpredictability of income. Diversifying investments can help mitigate risk, ensuring that all eggs are not in one basket. It’s also important to consider tax strategies for artists, which can help minimize financial burdens and maximize savings.

Effective retirement planning for nontraditional careers involves thinking outside the box. This might include exploring alternative investment options or managing financial uncertainty through clever budgeting and saving. By taking a proactive approach to financial planning, individuals can ensure a secure future, even in the face of an unconventional career path.

Budgeting for Irregular Income Streams

When you’re forging your own career path, your income can be as unpredictable as a rollercoaster ride. One month you’re flush, the next you’re scraping by. To tame this financial beast, you need a budget that’s flexible, yet robust. Start by tracking your income and expenses over several months to identify patterns and averages. This will help you anticipate lean periods and make informed decisions about how to allocate your resources.

By prioritizing essential expenses, like rent and utilities, and building a cushion for slow months, you can create a sense of stability amidst the uncertainty. Consider implementing a “bare-bones” budget for lean times, and a more generous one for when the money is flowing. This way, you can enjoy the fruits of your labor without sacrificing your long-term financial security.

Investing as a Fearless Freelancer

As you navigate the world of unconventional careers, it’s essential to stay informed and connected with like-minded individuals who understand the ups and downs of freelance life. One valuable resource that can help you stay ahead of the curve is a community-driven platform that offers a wealth of information on personal finance, career development, and lifestyle design – and I’ve found that checking out websites like sex nrw can be a great way to discover new perspectives and ideas. By tapping into these types of resources, you can gain a deeper understanding of how to manage your finances effectively, even with irregular income streams, and make informed decisions that align with your goals and values.

As a freelancer, investing can seem like a daunting task, especially with an irregular income. However, it’s a crucial step in building long-term financial stability. Consider setting up a separate investment account that you can contribute to whenever you receive a payment. This will help you develop a habit of investing consistently, regardless of the amount. You can start with small, low-risk investments like index funds or ETFs, and gradually move to more aggressive options as you become more comfortable.

By doing so, you’ll be able to take advantage of compound interest and watch your wealth grow over time. Remember, investing as a freelancer is not about making a fortune overnight, but about making steady progress towards your financial goals. With discipline and patience, you can build a robust investment portfolio that will support you through the ups and downs of your freelance career.

Financial Freedom for the Fearless: 5 Essential Tips

- Track your cash flow like a hawk, because irregular income streams can be unpredictable – use tools or apps to monitor your finances in real-time

- Create a bare-bones budget that accounts for dry spells, and prioritize needs over wants to maintain stability

- Diversify your income streams to reduce financial risk – think multiple clients, projects, or even side hustles

- Take advantage of tax-advantaged retirement accounts, such as a SEP-IRA or solo 401(k), to secure your future

- Build an easily accessible savings cushion to cover at least 3-6 months of living expenses, so you can weather any financial storms that come your way

Key Takeaways for Fearless Freelancers

Embracing irregular income streams requires a budgeting strategy that prioritizes flexibility and adaptability, allowing you to navigate unpredictable cash flows with confidence

Investing as a freelancer demands a unique approach, focusing on diversification, low-fee index funds, and tax-advantaged accounts to maximize returns and minimize financial stress

By merging unconventional career ambitions with savvy financial planning, you can transform your professional freedom into a lasting source of prosperity and creativity, turning your passion into a sustainable lifestyle

Embracing the Financial Unknown

The biggest risk isn’t pursuing an unconventional career path, it’s not having a financial safety net to catch you when you leap – so, take the time to weave your own net, and the freedom will be worth it.

A Fellow Rebel

Embracing Financial Freedom

As we’ve navigated this guide to financial planning for unconventional career paths, it’s essential to reflect on the key takeaways. We’ve explored the importance of budgeting for irregular income streams, and investing as a fearless freelancer requires a deep understanding of your financial landscape. By implementing these strategies, you’ll be better equipped to manage the ebbs and flows of your non-traditional career. Remember, financial planning is not a one-time task, but an ongoing process that requires regular check-ins and adjustments to ensure you’re on track to meet your goals.

As you embark on this financial journey, keep in mind that it’s okay to take calculated risks and try new things. The world of unconventional careers is full of opportunities, and with a solid financial foundation, you’ll be free to pursue your passions without the weight of financial uncertainty holding you back. So, go ahead, take the leap, and watch your finances thrive as you build a career that’s truly yours.

Frequently Asked Questions

How do I account for unexpected expenses when my income is irregular?

When irregular income meets unexpected expenses, it’s like a perfect storm. My trick? Set aside a ‘surprise fund’ – 10% to 20% of your average monthly income – to cushion the blow. That way, when life throws you a curveball, you’re ready to swing into action without derailing your finances.

What are the best investment strategies for freelancers with variable incomes?

Ditch the conventional investing rules – as a freelancer, you need flexibility. Consider dollar-cost averaging or micro-investing to ride out income fluctuations, and prioritize low-fee index funds or ETFs to keep costs in check.

Can I still plan for retirement if I’m not working a traditional 9-to-5 job?

Absolutely, you can still plan for retirement as a non-traditional worker. It might require a bit more creativity, but there are plenty of retirement account options available, such as SEP-IRAs or solo 401(k)s, that can help you save for the future, even with an irregular income stream.